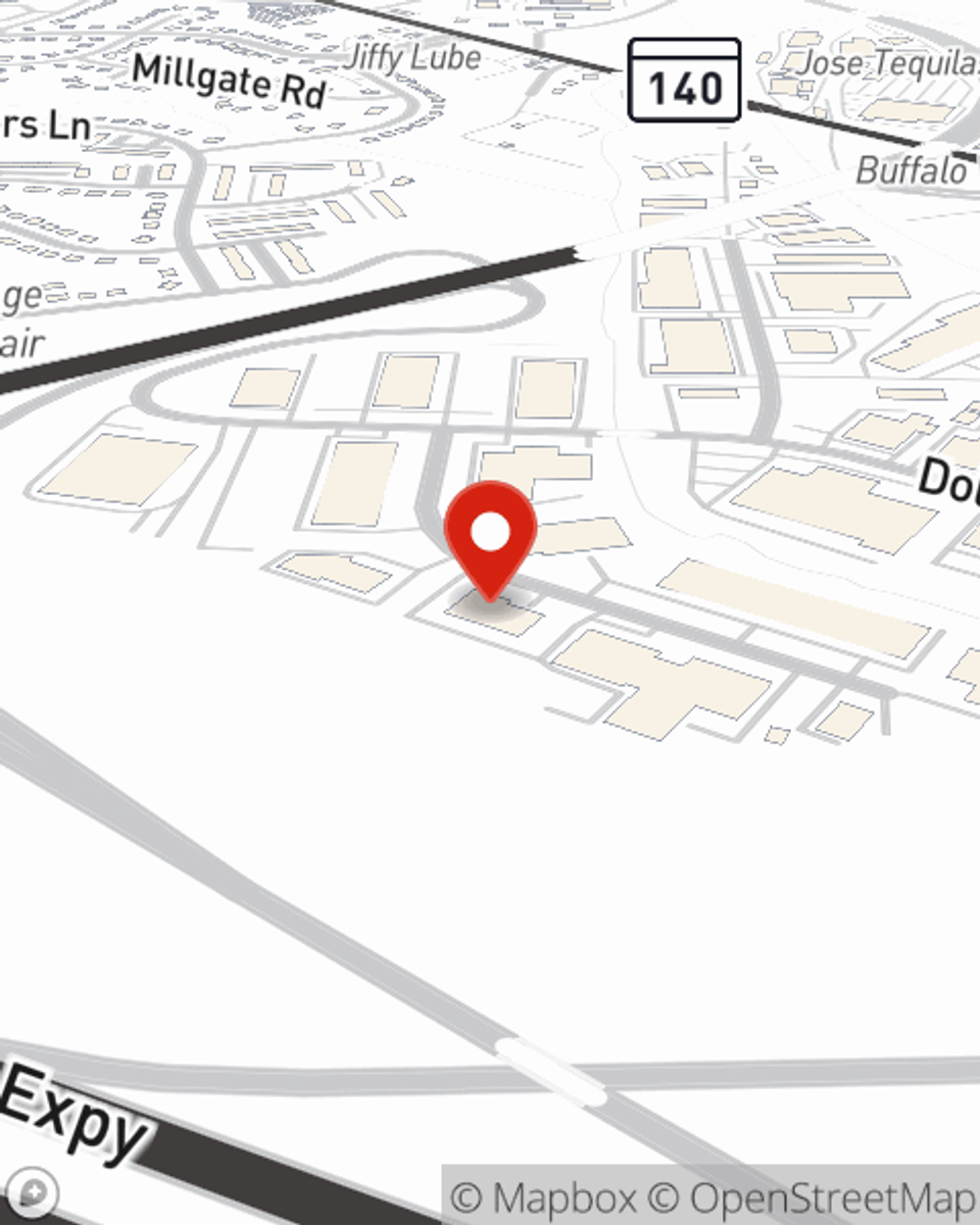

Business Insurance in and around Owings Mills

Looking for small business insurance coverage?

Helping insure small businesses since 1935

- Owings Mills

- Reisterstown

- Bel Air

- Pikesville

- Eldersburg

- Westminster

- Towson

- Columbia

Coverage With State Farm Can Help Your Small Business.

Running a small business requires much from you. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, retailers, trades and more!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Surprisingly Great Insurance

Your business thrives off your passion commitment, and having great coverage with State Farm. While you put in the work and do what you love, let State Farm do their part in supporting you with artisan and service contractors policies, commercial liability umbrella policies and worker’s compensation.

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Randy Somers's office today to discuss your options and get started!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Randy Somers

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.